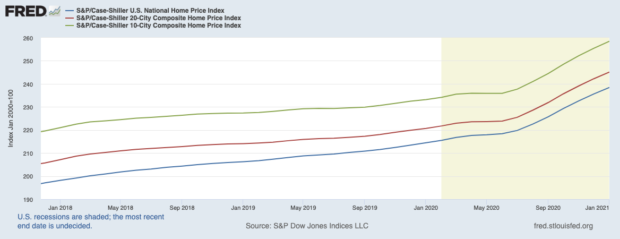

With the Case-Shiller numbers for February being released in the morning, virtually all signs indicate that the latest release of the index, which measures changes in single-family home prices, will show accelerated growth, the trend that’s been in place since the latter half of 2020. While the pandemic had eviscerated much of the economy last year, home prices have continued climbing, and economists are forecasting that’ll be the story for the better part of 2021.

Here are five things that today’s Case-Shiller numbers is likely to show:

1. Another month of rapid home price growth

Released with a two-month lag, economists’ average estimates for the Case-Shiller 20-city composite, which measure home growth in the 20 largest metros in the country, is about 11.9% growth in February compared to the same month last year. That would best last month’s 11.1% annual gain and would stay in trend with the double-digit annual gains that have been occurring since mid-2020.

2. With a depleted housing stock, things aren’t likely to change anytime soon

Like all markets, it boils down to supply and demand. And there simply aren’t enough houses on the market to stop prices from climbing at these accelerated rates.

The National Association of Realtors found home sales fell 3.7% in March from February. That’s not because there isn’t demand though. Inventory is down by 28.2% compared to the same time last year, with properties typically selling in just 18 days.

“We need to be building tons of more homes,” said Troy Ludtka, an economist at Natixis North America LLC. “I know that’s a very untechnical phrase, but we have a massive housing deficit. We need to build.”

3. Mortgage rates remain enticing

Around June of last year, the average 30-year fixed interest rates dropped below 3%, the lowest they’ve been in years. While mortgage rates have since inched over the 3% rates, they’re still historically low. And they’re a far cry from where they’d have to be —having reached 4.88 in October 2018 — for buyers to be deterred, economists say.

“When you look at affordability and mortgage rates, they have climbed here, but they’re nowhere near binding on the homebuyer,” said Stan Shipley, senior managing director and economist at Evercore ISI. “we need to get mortgage rates up at least 100 basis points before they become another issue.”

4. The big winners are going to keep winning

Phoenix, Seattle, San Diego. Those have been the metro areas experiencing the most growth during this hot housing market, and it’s likely that they’ll continue to keep it going.

In Phoenix, where the burning demand is leading to bidding wars and lotteries, the median sales prices was up 24.8% March 2021 compared to last year. While total inventory was up 3.4% in March compared to February, it’s down 50.4% compared to last year.

5. Work from home phenomenon at the heart of this

If workers don’t have to live near their jobs anymore, why not move to a more spacious, cheaper home further? It’s the big question that’s being answered in real time as people flock from the largest metros to the suburbs.

In the west, Phoenix, San Diego and Seattle are seeing home prices rocket, with residents of Los Angeles and San Francisco looking for new, and more affordable, pastures. Similarly, New Yorkers are moving to the New Jersey suburbs, as they enjoy the flexibility that comes with working from home or some sort of hybrid office-home hybrid model.

“You can’t put the toothpaste back in the tube,” Ludtka said. “The difference is a work from home dynamic is a much more efficient arrangement for the workforce and for corporations. Commuters obviously save a ton of time, and money and commuting also allows them to move outside of expensive inner-city areas. It also allows for businesses to save tons of money on corporate real estate.”

Photo by Blake Wheeler on Unsplash