With thousands of factories shuttered and transportation mostly ground to a halt, Friday’s Census Bureau monthly durable goods report will be a snapshot of a market in free fall. Here are some things to look out for.

A Decrease in Orders Could be Steep. Historically Steep

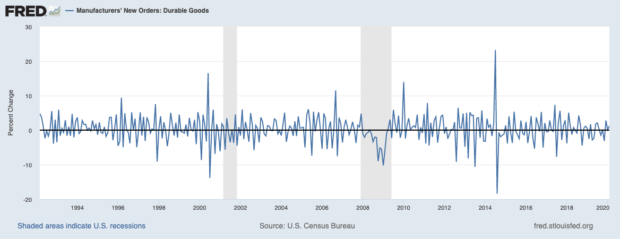

The worst recorded one month drop in all durable goods orders was 18.4 percent in August 2014, according to the Census Bureau, which began publishing the data in 1992. That record may be broken tomorrow with economists forecasting anywhere between a 9 and 20+ percent decrease for March. Last month was the first to see mass work closures and layoffs due to the COVID-19 pandemic, and these measures will take a big toll on tomorrow’s numbers.

Look For Transportation Woes to Power the Plunge

With auto plants closed and air travel virtually non-existent, economists are looking toward especially bad transportation numbers tomorrow.

“The auto factories closing is highly unusual, so that will be a huge transportation hit,” says Robert Englund, chief economist at Action Economics.

Air transportation orders, already dogged by Boeing’s woes predating the virus, may drop precipitously tomorrow, and possibly for many months to come. It is hard to predict how comfortable people will be in the close confines of an airplane or train compartment even after the virus has subsided.

Pay Attention to Which Areas Are Effected the Most

Transportation products-as well as those bought for national defense-are considered non-core durable goods because their sales tend to fluctuate regardless of the state of the economy. Just a few big ticket items like an aircraft carrier can strongly tip the scales.

A much better gauge of the economy are orders of core durable goods: washing machines, tractors, ovens-orders of these tend to reflect consumer and business sentiment as a whole. But, with millions unemployed and buyers strapped for cash, economists are predicting a big drop in core orders-5 percent or more.

Don’t Expect a Very Clear Picture Just Yet

While tomorrow’s report will be the first to encompass many of the major COVID-19 response ripple effects, it still cannot nearly keep up with all the rapid changes affecting the marketplace. Many statewide shutdowns did not start until well into the month, and this should soften any negative numbers. April’s report will be a much clearer-and potentially much more devastating-account of the market for durable goods during the pandemic.

“The real collapse in the economy didn’t start until mid-March. The April numbers will be much weaker,” says Jim O’Sullivan, chief macro strategist at TD Securities.

The Oil Wild Card Going Forward

The price of oil sunk below zero earlier this week following a prolonged price war between Russia and OPEC. While this will not be reflected in tomorrow’s report, the price of oil plays a key role in the durable goods market, affecting everything from the price of a gallon of gasoline to the supply of vital capital goods like drills and pipelines. While cheap fuel may seem like a fringe benefit for consumers and airlines, a lack of demand for driving and flying should mostly cancel this out.