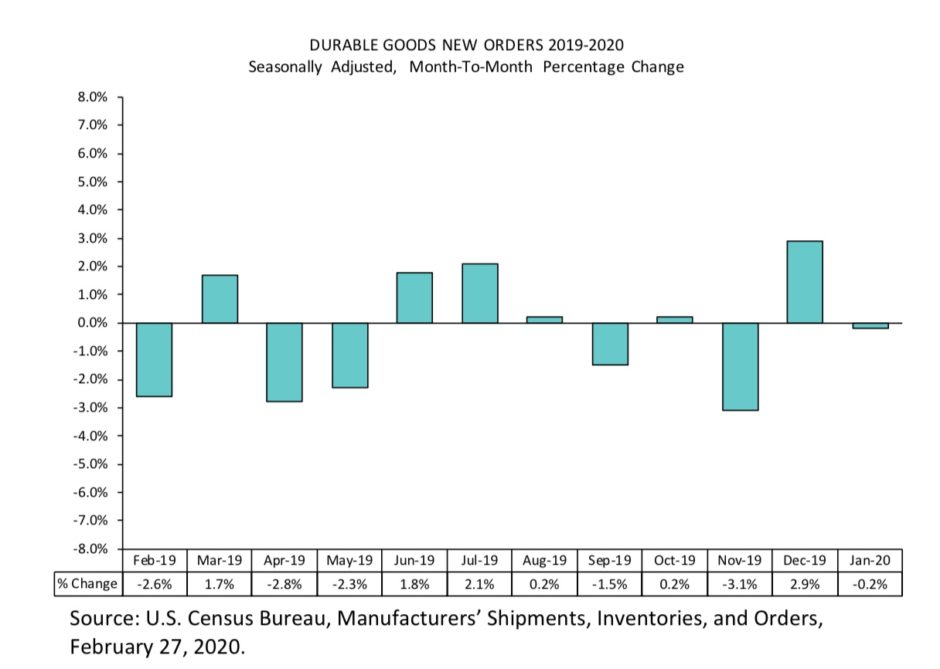

Orders for most durable goods rose solidly in January, but with the Coronavirus impact barely accounted for, the future remains murky.

The Census Bureau’s monthly durable goods report showed non-defense orders increased to 3.6% while non-transportation orders improved 0.9%. Orders of non-defense capital goods saw an even more marked increase of 12.4%.

“There has been a pick up recently in core capital goods, which is a good thing,” says senior Bloomberg economist Yelena Shylyateva.

Headline durable goods orders, including transportation and defense purchases, decreased slightly, 0.2%. But, an increase in core orders-which includes staples such as phones, cars and washing machines-is usually considered a sign of good consumer sentiment, and a positive outlook for the economy as a whole.

Yet, Coronavirus fears have ravaged stocks this last week, and January’s numbers tell us little about the resulting impact on global supply chains. Growing concerns over transportation orders, led by Boeing’s continued troubles, further complicate the picture going forward.

The aerospace giant had another difficult month. Production of its 737 Max jet is still suspended, and the company delivered only 13 aircraft this month, down 22 from December. Boeing was not alone, as orders of transportation equipment as a whole dipped 2.2% from December, decreasing for the fourth time in five months.

“Transportation is pretty flat (other than Boeing),” says Robert Brusca, President at Fact and Opinion Economics.

A 3.6% decrease in defense purchases further depressed non-core orders. It was an expected let down after a splurge in military orders following congress passing a large increase in defense spending.

But, the biggest concern is the looming impact of the Coronavirus. Its unpredictable spread has already wrecked havoc on numerous markets, and its effect on durable goods should be felt sooner rather than later.

“Companies need money to invest. (Coronavirus) will significantly distort earnings,” says Shylyateva.

The most recent data cannot account for the rapid changes occurring as the virus spreads across the world. This makes future projections especially difficult.

“We cannot trust seasonally adjusted data right now,” adds Shylyateva.

While January had some positive developments, there is too much current uncertainty to see more growth ahead.

“I would take any upbeat reports with a big grain of salt right now,” says Brusca.