The expansion of the service sector continued last month, but at a slower pace, raising concerns about the recovery of the U.S. economy.

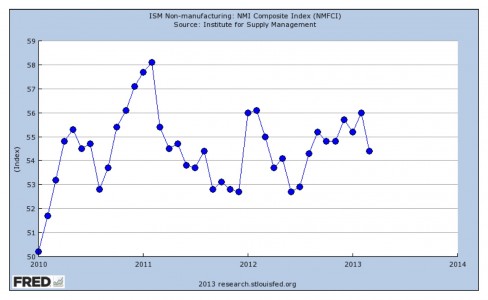

The non-manufacturing index of the Institute for Supply Management (ISM) fell to 54.4 from a 12-month high at 56 in January, returning at the same level as its one year average. Yet March’s growth was the slowest in seven months. Any reading above 50 indicates expansion in service industries, which make up more than 85% of the country’s economy. March was the 39th consecutive month that the index expanded.

“We had such a strong increase last month that now, I think, the index returns to a more sustainable growth rate,” said Anthony Nieves, chairman of the ISM’s non manufacturing survey committee.

The slower growth pace reflected a drop in hiring, a sub-index of the survey with close correlation to the report on employment issued by the Bureau of Labor Statistics. A separate survey released on Wednesday from payroll processor ADP showed that the private sector added only 158,000 jobs in March, the smallest gain since last October.

The two figures raised concerns among economists that Friday’s jobs report could be much weaker than initially anticipated. In the past four months, job growth has averaged a little over 200.000 jobs, a high enough number to help with the decrease of the unemployment rate.

Cyprus’ recent banking woes renewed fears about the fate of Euro and had a direct, albeit mostly psychological, impact in the sector’s confidence, Nieves suggested. This in turn affected the employment prospects of the service industries, which learned during the Great Recession “how to do more with less resources.”

“We didn’t see much of capital reinvestment this month,” Nieves added.

On the contrary, the fiscal debate in Washington didn’t affect as much the outcome of the sector’s growth. The only service seriously hurt by the across-the-board cuts was health care. The particular sector was one of the only three non-manufacturing industries that reported contraction in March. Fifteen reported growth.

“Given that the population continues to age, the long term prospects of health services look good,” said Jennifer Lee, vice-president and senior economist of BMO Capital Markets. “But the contraction was a bit eye-raising about the effects of budget cutbacks.”

The housing industry was the strongest sector for another month, even though construction slowed down because of the winter weather conditions.

“The housing sector will continues to grow. It’s a powerful industry,” Lee said. “Everything that has to do with housing. From construction to building materials. When you buy a new home, you have to buy new furniture.”

In the housing business, rental and leasing remain strong, although consumers are gradually shifting back into home-ownership, taking advantage of the lower interest rates offered in the market.

Yet in the big metropolitan centers demand of rental services is still high.

“We know that things has slowed down in the rest of the country, but New York in an entirely different animal,” said Eli Nahmias, owner of the Esam Realty LLC a real estate firm based in Long Island, NY.

“Here the market is still booming,” Nahmias said. “We’ve seen new businesses coming over in the last few years. New businesses need to hire more people and more people need more housing space.”