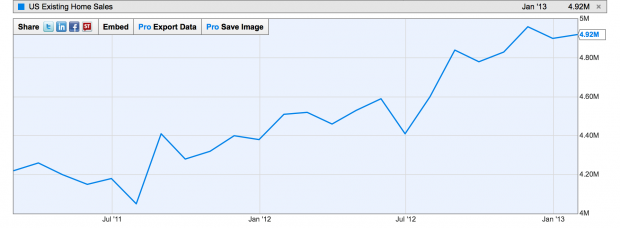

Sales of existing homes in the United States climbed in January, as homebuyers faced a tight supply of homes on the market.

Existing home sales rose to a seasonally adjusted annual rate of 4.92 million, a 0.4 percent increase from the revised December figure, according to data released by the National Association of Realtors Thursday. The increase points to a continued recovery of the housing market, despite a brief slip in sales in December. There were 4.66 million houses sold last year, the most since 2007.

“The housing rebound has been gaining steam over the last year, but it’s an incremental thing, not all at once. A down month is bound to happen at some point,” said Nathaniel Karp, chief economist for BBVA Compass. “January’s numbers are a continuation of the trend.”

The limited supply of homes on the market can be attributed, in part, to low home values. Many potential sellers owe more on their mortgages than their house is worth, so they have opted to hold off on selling until prices rise.

Home values have already started to climb as buyers compete for fewer homes. With the lowest housing inventory available since 2005, the median sale price of a house rose to $173,600. This is 12.3 percent higher than it was a year ago and marks the 11th consecutive month of year-over-year price increases for the first time in seven years.

The rise in prices has prompted buyers who waited for prices to bottom out to get back in the market. Near record low mortgage rates and solid employment numbers have also led more buyers to flood the market.

“A lot of it is how confident our buyers are feeling,” said Richard Moody, chief economist at Regions Financial Corporation. “This is one reason continued job growth and income growth are critical.”

Distressed home sales, which involve houses either foreclosed on or sold for less than what is owed on its mortgage, have been falling. These homes have been a source of strength for sales, especially in the West. They accounted for 23 percent of purchases, compared to 35 percent a year ago.

The spring selling season, which generally begins near mid-March, will bring more housing inventory, but demand is expected to remain strong to enough keep supply tight. Ultimately, new home construction will have to fill the supply gap of available homes.

Construction will boost employment figures, with each new home built creating about three jobs for a full year, according to the National Association of Homebuilders.

The jobs created by new construction could have a big impact on the economy, which in turn could help the housing market.

“We’re going to see the pace of job and income growth go up this year,” Moody said. “And we’re going to see a bigger number of first time buyers.

More job growth brings more first time buyers to the market. Traditionally they have a major impact on the economy. They purchase more furnishings and other goods associated with homeownership than other buyers, especially investors, who merely buy homes to rent them out

Investors, many of whom bought distressed homes at a bargain price, have been a driving force behind recent sales. But as distressed properties wane and prices rebound, less of them are expected to buy homes.

“I am looking for a change in the composition of buyers,” Moody said. “I am looking for a transition away from investor purchases towards purchases by more mortgage-reliant borrowers.”